Keeping an Eye on Your Profit Margin

- Strength in Numbers

- Aug 21, 2024

- 3 min read

Updated: Dec 29, 2024

At Strength in Numbers Limited, one of the most critical aspects of financial health we emphasize to business owners is the importance of monitoring and maintaining a healthy profit margin. Profit margin isn’t just a number on a financial statement; it’s the pulse of your business, providing insights into your operational efficiency, pricing strategy, and overall financial well-being. Understanding and keeping an eye on your profit margin can mean the difference between thriving and merely surviving in today’s competitive market.

What is Profit Margin?

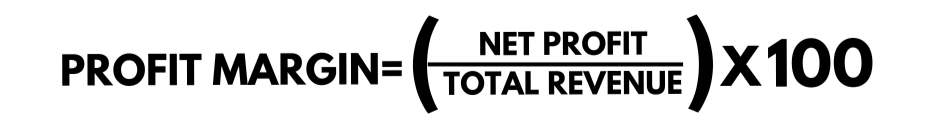

At its simplest, the profit margin is the percentage of revenue that remains as profit after all expenses are deducted. It can be calculated using the formula:

There are different types of profit margins to consider:

- Gross Profit Margin: This measures the percentage of revenue that exceeds the cost of goods sold (COGS). It focuses on the core business activities and is a key indicator of production efficiency.

- Operating Profit Margin: Also known as EBIT (Earnings Before Interest and Taxes) margin, this takes into account operating expenses, providing insight into how well a business controls its costs.

- Net Profit Margin: The bottom line, showing the percentage of revenue left after all expenses, taxes, and interest. This margin indicates overall profitability.

Each of these margins offers valuable information, and together, they provide a comprehensive view of a company’s financial performance.

Why Monitoring Profit Margin Matters

1. Identifying Financial Health:

The profit margin is a direct indicator of financial health. A consistently strong margin suggests that a business is well-managed and has good control over its costs. Conversely, a declining margin may indicate rising expenses, pricing issues, or operational inefficiencies.

2. Strategic Decision-Making:

Profit margin analysis aids in strategic decisions, such as pricing strategies, cost control measures, and investment opportunities. If your gross margin is shrinking, it may be time to reassess your pricing or negotiate better terms with suppliers.

3. Benchmarking:

Regularly reviewing your profit margin allows you to benchmark your performance against industry standards or competitors. This comparison can reveal areas where you are excelling or need improvement.

4. Sustainability:

A healthy profit margin ensures that your business can sustain operations, reinvest in growth, and weather economic downturns. It’s also a key factor that investors and lenders consider when assessing the viability of your business.

Common Pitfalls to Avoid

1. Ignoring Small Changes:

Even slight changes in your profit margin can signal bigger issues. For example, a 1% drop in net profit margin might seem minor, but over time it can lead to significant losses.

2. Overlooking Indirect Costs:

Focusing only on direct costs while ignoring indirect costs (like utilities, rent, and administrative expenses) can paint an inaccurate picture of your profitability. Operating profit margin provides a clearer view by incorporating these costs.

3. Neglecting Regular Review:

Profit margins should be reviewed regularly, not just at year-end. Monthly or quarterly reviews allow for timely adjustments and help prevent small issues from becoming major problems.

4. Misinterpreting Margins:

A high profit margin isn’t always a sign of success, especially if it’s achieved by cutting corners on quality or underpaying staff. Sustainable profit margins are built on a foundation of good business practices, customer satisfaction, and ethical operations.

Practical Steps to Improve Your Profit Margin

1. Optimize Pricing:

Regularly review your pricing strategy to ensure it reflects market conditions and covers your costs. Consider value-based pricing to capture the true worth of your product or service.

2. Cost Control:

Implement cost-saving measures without compromising quality. Negotiate with suppliers, reduce waste, and streamline operations to lower your expenses.

3. Increase Efficiency:

Invest in technology and training that enhances productivity. Efficient processes reduce time and resources needed to produce goods or services, thereby improving your margin.

4. Diversify Revenue Streams:

Expanding your product line or entering new markets can boost revenue and improve your profit margin. However, ensure these ventures align with your core business strengths to avoid diluting your brand.

Conclusion

Monitoring your profit margin is not just a financial exercise; it’s a strategic necessity. At Strength in Numbers Limited, we encourage business owners to view their profit margin as a vital sign of business health. By understanding what drives your margins and taking proactive steps to maintain or improve them, you can ensure the long-term success and sustainability of your business. Remember, a healthy profit margin isn’t just about making money; it’s about making smart, informed decisions that lead to sustained growth and stability.

Comments